Page 160 - CTS - Sewing Technology - TP - Volume - 2-0

P. 160

SEWING TECHNOLOGY - CITS

Based on our existing cost sheet, we can make estimates of our costs for the next financial year. It helps to

prepare and make the necessary arrangement of funds for costs of the next financial year.

Elements of Cost

Prime Cost: It comprises direct material, direct wages, and direct expenses. Alternatively, the Prime cost is the

cost of material consumed, productive wages, and direct expenses.

Factory Cost: Factory cost or works cost or manufacturing cost or production cost includes in addition to the

prime cost, the cost of indirect material, indirect labour, and indirect expenses. It also includes the amount or units

of WIP or incomplete units at the end of the period.

Cost of Production: When Office and administration cost at the end of the period are added to the Factory cost,

we arrive at the cost of production or cost of goods sold. Here, we make an adjustment for opening and Closing

finished goods.

Total Cost: Total cost or alternatively cost of sales is the cost of production plus selling and distribution overheads.

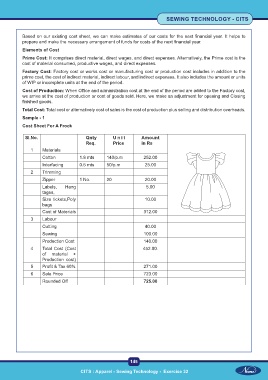

Sample - 1

Cost Sheet For A Frock

Sl.No. Qnty Unit Amount

Req. Price in Rs

1 Materials

Cotton 1.8 mts 140/p.m 252.00

Interfacing 0.5 mts 50/p.m 25.00

2 Trimming

Zipper 1 No. 20 20.00

Labels, Hang 5.00

tages,

Size tickets,Poly 10.00

bags

Cost of Materials 312.00

3 Labour

Cutting 40.00

Sewing 100.00

Production Cost 140.00

4 Total Cost (Cost 452.00.

of material +

Production cost)

5 Profit & Tax 60% 271.00

6 Sale Price 723.00

Rounded Off 725.00

145

CITS : Apparel - Sewing Technology - Exercise 32